Personal Finance Pilot Class

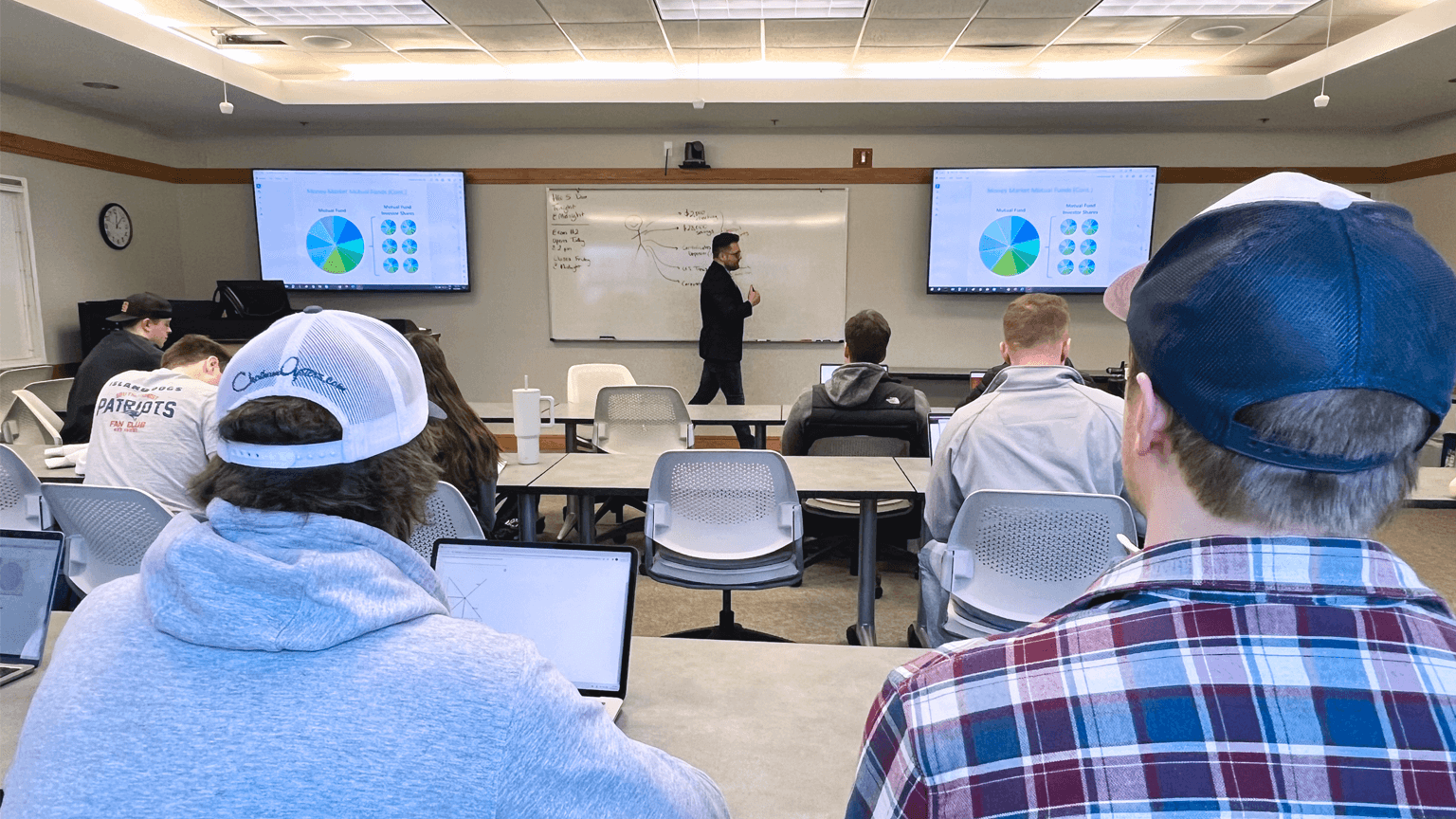

This year the Maine Business School piloted an undergraduate class focused on personal finance. Taught by cooperating faculty member Matt Skaves, the course reached learners ranging from first-year students to seniors.

“The idea behind this course was to enhance accessibility for students and focus on key personal finance elements that college students face,” says Dr. Jason Harkins, Executive Dean of the Maine Business School. Offered for the first time in the fall of 2022, this pilot course was made possible thanks to a generous gift from Pat Maiorino, ’69.

“I have friends in their 50s who could probably benefit from a class in personal finance, so the need isn’t just at the undergraduate level,” Skaves says. “But with respect to undergraduates, it is really important for them to set themselves up for financial success as early as possible.”

Skaves points out that everyone can benefit from having a basic understanding of things like credit, personal loans, investments, etc. And while there is a lot of good information on the internet, there’s also a lot of misinformation, particularly on social media. One goal of this course is to help students become better-informed consumers of financial information so they can be less influenced by what they read or watch online.

“This class is one that I thought would be most applicable to me and my financial future, not just my degree,” says Abigail Mailly, a sophomore Accounting major. “From building credit and borrowing money to budgeting and saving for goals, the class covers material we all wish we were taught in high school. This class feels like it is meant to prepare us for the more personal side post-graduation – our finances and achieving our larger, more daunting goals.”

The semester-long course begins with the basics of building good credit and borrowing wisely. Students then learn how to budget and invest any short-term cash surplus. Next comes discussions about longer-term savings goals, including long-term investments like stocks and bonds. Lastly, the class finishes with information on how to protect financial lives through insurance and how to diversify and advance human capital.

“I like that this is an applied course, and students will walk away with tangible life skills that will positively impact their future,” Skaves says. “Students who start this course generally have a partial understanding of the concepts we discuss, but not a full enough understanding to make optimal decisions.” Since his class includes first-years to seniors, Skaves strives to teach purposefully so that less experienced students aren’t lost, and more experienced students stay engaged.

“I would absolutely recommend this class to other students; I actually already have!” Mailly says. “Great teachers who care about their work are so important to me. Matt Skaves is an amazing example of that. He’s incredibly knowledgeable and an incredible resource and teacher.”