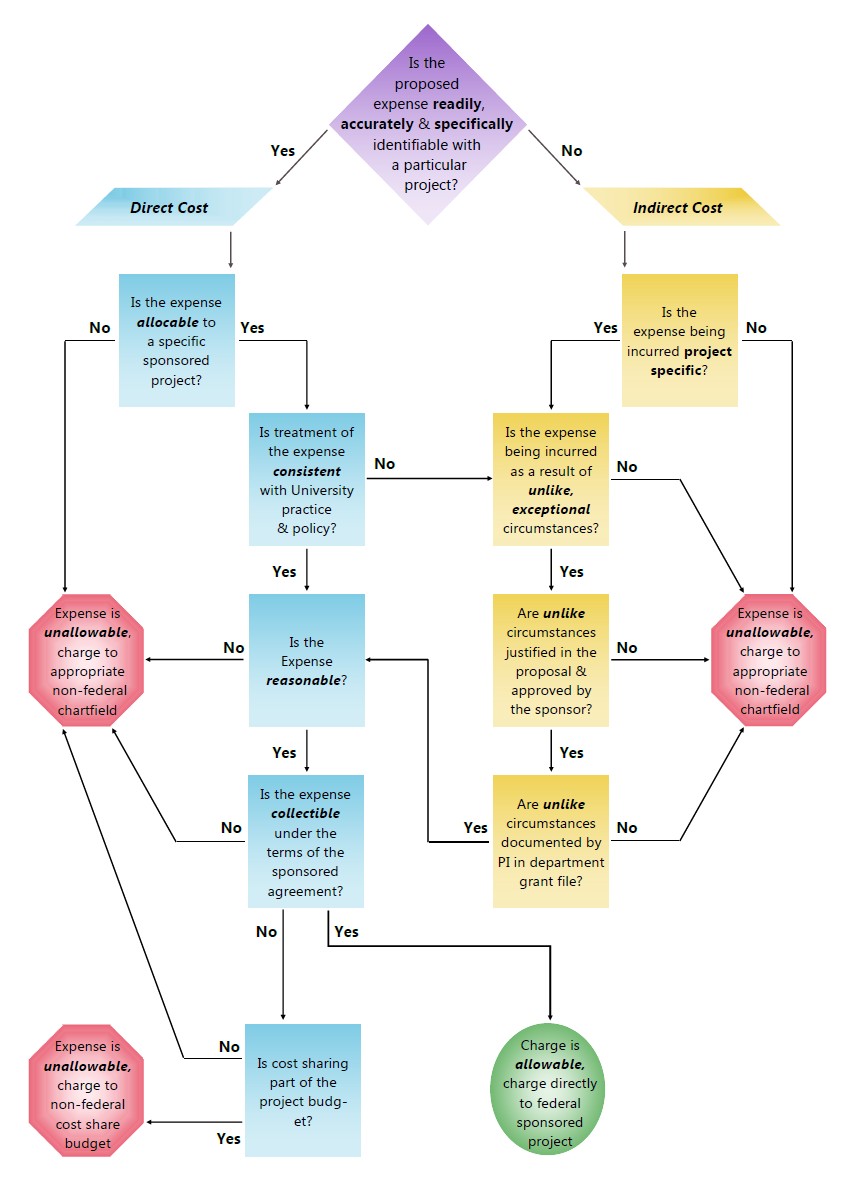

Allowable Costs Flowchart

The following flowchart outlines the steps to determine if a proposed expense is an allowable Direct Cost or an allowable Indirect Cost for a specific federally-sponsored project.

Jump to

Flowchart Logic

Starting Question

Is the proposed expense readily, accurately and specifically identifiable with a particular project?

If Yes…

The expense is categorized as a direct cost. Then, the following questions are asked and handled accordingly:

- Is the expense allocable to a specific sponsored project?

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, proceed to next question

- Is treatment of the expense consistent with University practice & policy?

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, proceed to the next question

- Is the expense reasonable?

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, proceed to the next question

- Is the expense collectible under the terms of the sponsored agreement?

- If no, additionally check if cost sharing is part of the project budget

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, the expense is unallowable and should be charged to non-federal cost share budget

- If yes (the expense is collectible under the terms of the sponsored agreement), the charge is allowable and should be charged directly to the federal sponsored project

- If no, additionally check if cost sharing is part of the project budget

If No…

The expense is categorized as an indirect cost. Then, the following questions are asked and handled accordingly:

- Is the expense being incurred project specific?

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, proceed to next question

- Is the expense being incurred as a result of unlike, exceptional circumstances?

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, proceed to next question

- Are unlike circumstances justified in the proposal and approved by the sponsor?

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, proceed to next question

- Are unlike circumstances documented by PI in department grant file?

- If no, the expense is unallowable and should be charged to appropriate non-federal chartfield

- If yes, proceed to Question #3 (“Is the expense reasonable?”) under the “If Yes” (AKA the direct cost) section of questions to ask. If answers to “is the expense reasonable” and “is the expense collectible under the terms of the sponsored agreement” are both yes, the charge is allowable and should be charged directly to the federal sponsored project

Uniform Guidance Quick Reference Criteria for Determining the Allowability of Costs on Federally-Sponsored Projects

Part 200.403 – Factors Affecting Allowability of Costs

The tests of allowability of costs under these principles are: (a) they must be reasonable; (b) they must be allocable to sponsored agreements under the principles and methods provided herein; (c) they must be given consistent treatment through application of those generally accepted accounting principles appropriate to the circumstances; and (d) they must conform to any limitations or exclusions set forth in these principles or in the sponsored agreement as to types or amounts of cost items.

Part 200.404 – Reasonable Costs

A cost may be considered reasonable if the nature of the goods or services acquired or applied, and the amount involved therefore reflect the action that a prudent person would have taken under the circumstances prevailing at the time the decision to incur the cost was made. Major considerations involved in the determination of the reasonableness of a cost are: (a) whether or not the cost is of a type generally recognized as necessary for the operation of the institution or the performance of the sponsored agreement; (b) the restraints or requirements imposed by such factors as arm’s-length bargaining, Federal and State laws and regulations, and sponsored agreement terms and conditions; (c) whether or not the individuals concerned acted with due prudence in the circumstances, considering their responsibilities to the institution, its employees, its students, the Federal Government, and the public at large; and, (d) the extent to which the actions taken with respect to the incurrence of the cost are consistent with established institutional policies and practices applicable to the work of the institution generally, including sponsored agreements.

Part 200.405 – Allocable Costs

A cost is allocable to a particular cost objective (i.e., a specific function, project, sponsored agreement, department, or the like) if the goods or services involved are chargeable or assignable to such cost objective in accordance with relative benefits received or other equitable relationship. Subject to the foregoing, a cost is allocable to a sponsored agreement if (1) it is incurred solely to advance the work under the sponsored agreement; (2) it benefits both the sponsored agreement and other work of the institution, in proportions that can be approximated through use of reasonable methods, or (3) it is necessary to the overall operation of the institution and, in light of the principles provided in this Circular, is deemed to be assignable in part to sponsored projects. Where the purchase of equipment or other capital items is specifically authorized under a sponsored agreement, the amounts thus authorized for such purchases are assignable to the sponsored agreement regardless of the use that may subsequently be made of the equipment or other capital items involved.

For answers to specific questions or concerns related to the allowability of costs on federally-sponsored projects, please consult 2 CFR 200 Subpart E – Cost Principles (Basic Considerations), UMS APL VIII‐C: Sponsored Programs – Direct Charging Of Expenses, and/or contact ORA directly.

Return to